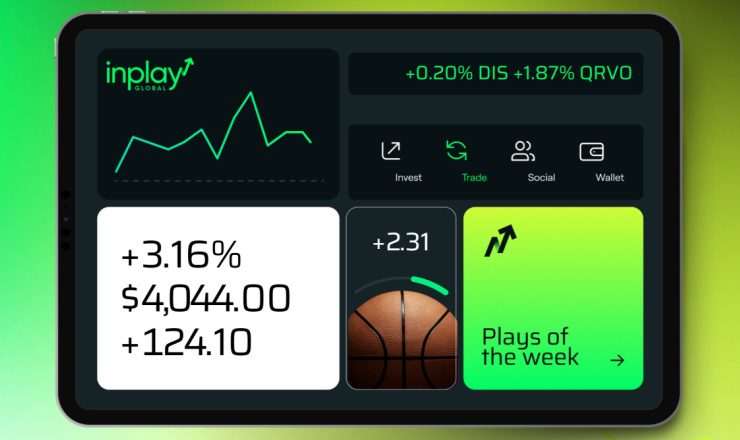

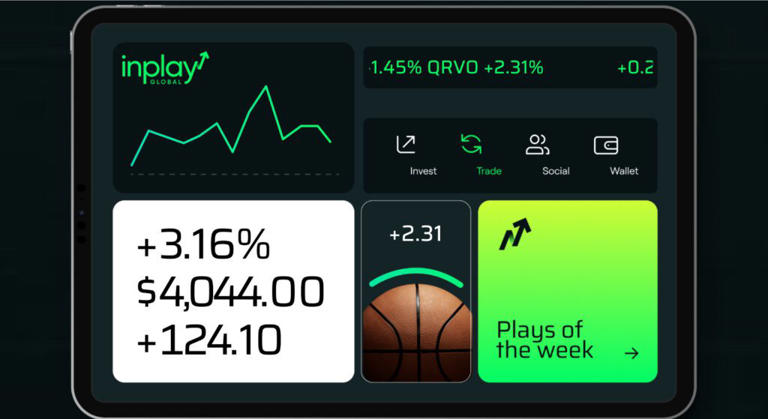

Exchange Invest (IPO-VID) – January 27, 2026 – ” Making Markets InPlay”

The former President of MIAX Futures, Troy Kane is now the President & COO of InPlay Global, Inc., an innovative financial platform turning team performance into an investable asset class…